Commission paycheck tax calculator

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Process Payroll Faster Easier With ADP Payroll.

Payroll Calculator Free Employee Payroll Template For Excel

In other words if you make a sale for 200 and your.

. Total annual income - Tax liability All deductions Withholdings Your annual paycheck How much is a paycheck on 40000 salary. It can also be used to help fill steps 3 and 4 of a W-4 form. Pay periods per financial year Pay periods per financial year refers to a total of 52 pay.

Ad Compare 5 Best Payroll Services Find the Best Rates. Select the tax year within which your payslip date is Remember a tax year runs from 6th April to 5th April. Just take sale price multiply it by the commission percentage divide it by 100.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Get Started With ADP Payroll. Get an accurate picture of the employees gross pay including.

You can calculator your commission by multiplying the sale amount by the commission percentage. Discover ADP Payroll Benefits Insurance Time Talent HR More. Make Your Payroll Effortless and Focus on What really Matters.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Payroll tax reporting and regulatory rules for accurate global processing and compliance. The taxes are calculated based on how your employer pays you normally.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your employer withholds a 62 Social Security tax and a. Ad Manage your diverse payroll requirements with Oracle Global Payroll.

Select how often you are paid - Monthly 4-Weekly 2-Weekly Daily. For single filer you will receive. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Get Started With ADP Payroll. Ad Create professional looking paystubs. Aggregated Annual Taxable Income With this method your tax is calculated by multiplying out your monthly earnings ie.

Discover ADP Payroll Benefits Insurance Time Talent HR More. How to calculate commission This is a very basic calculation revolving around percents. In a few easy steps you can create your own paystubs and have them sent to your email.

For example if an employee earns 1500 per week the individuals. Computes federal and state tax. Your gross salary including commission by an.

For example if your bonus or commission is included in your regular pay then its taxed according to normal. Employees who earn commissions without expenses If you pay commissions at the same time you pay salary add this amount to the salary then use the Payroll Deductions Online. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Then divide the total earnings by the number of pay periods to date including the current pay period. We use the most recent and accurate information. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

All Services Backed by Tax Guarantee. Ad Process Payroll Faster Easier With ADP Payroll.

8 Best Images Of Weekly Budget Worksheet Free Printable Bi Weekly Personal Budget E Budget Template Printable Budgeting Worksheets Printable Budget Worksheet

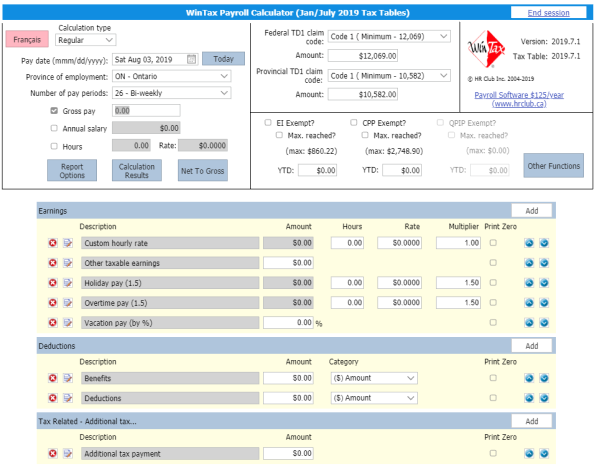

Wintax Calculator Wintax Canadian Payroll Software

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Commission Calculator Spreadsheet Spreadsheet Calculator Windom

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Net To Gross Calculator

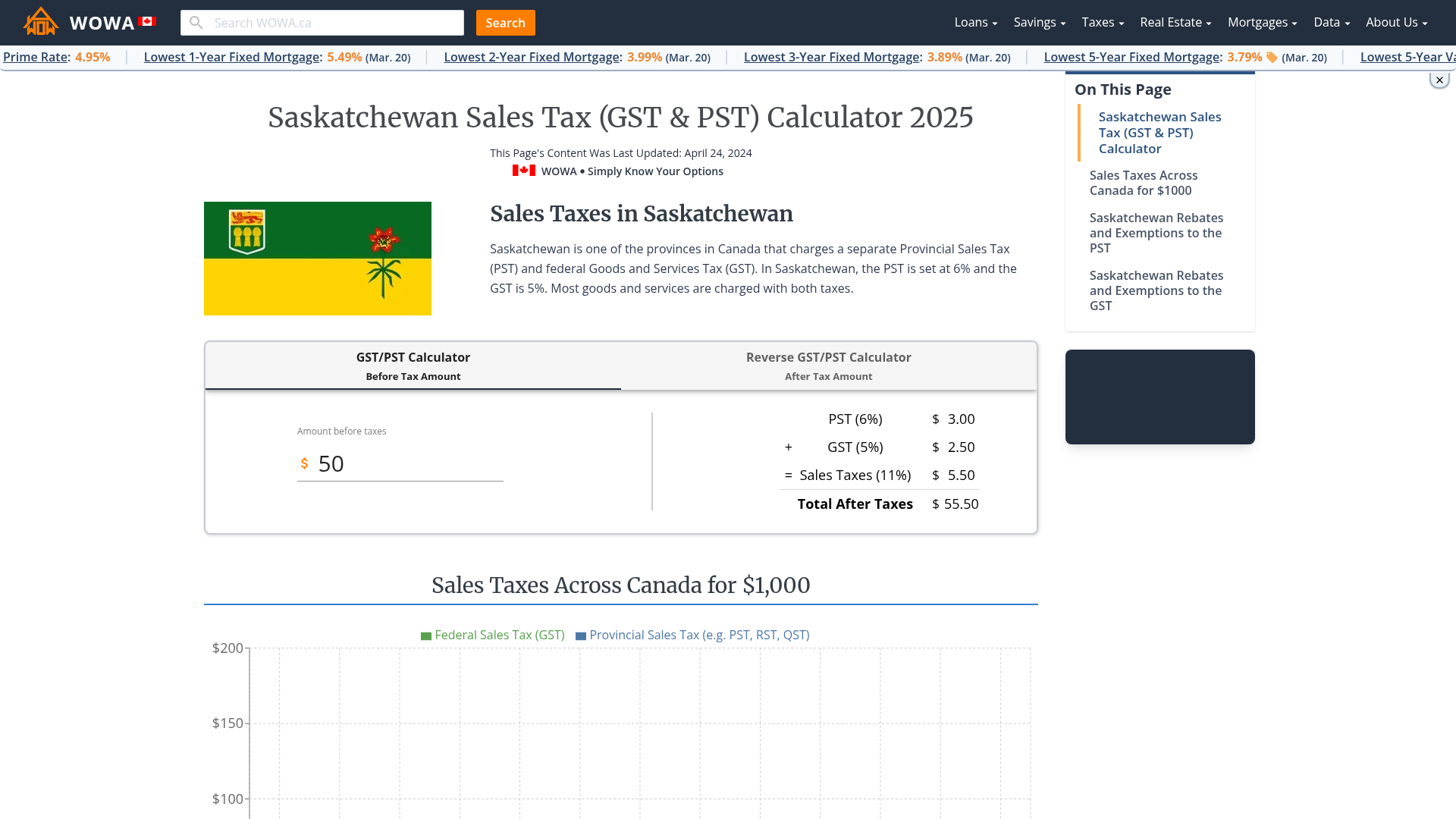

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

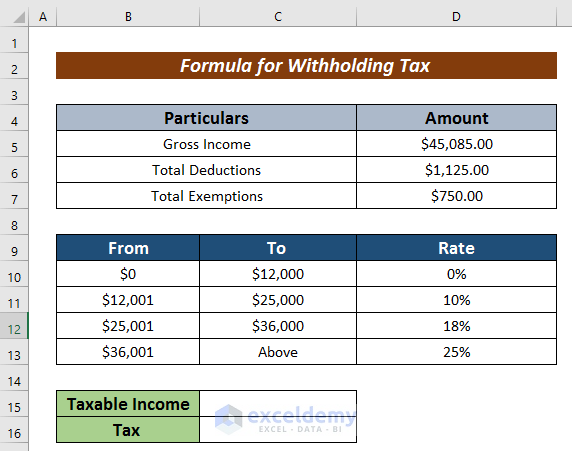

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

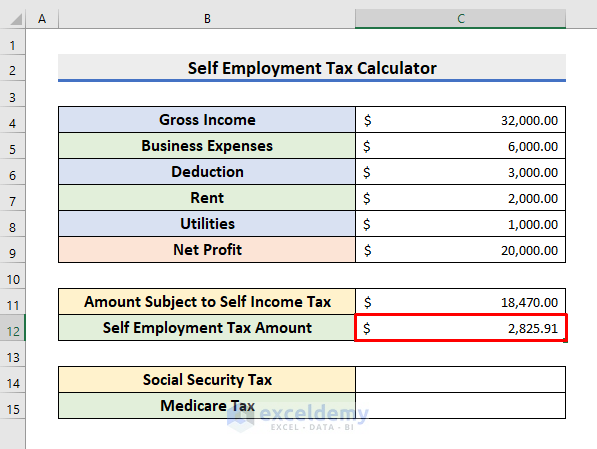

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Ontario Income Tax Calculator Wowa Ca

Avanti Bonus Calculator

Calculate Tax Amounts

2021 2022 Income Tax Calculator Canada Wowa Ca

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Excel Formula Income Tax Bracket Calculation Exceljet