How much do banks usually lend for mortgages

Why do most banks only accept 80. Major banks and lenders tend to vary significantly in the amount that theyll lend to property investors.

Best Mortgage Lenders Of July 2022 U S News

Americans are rich by world standards.

. Closing costs for a typical 30-year mortgage might run 3000. You can help improve your score by paying your bills on time checking your details are up to. The 900 from your 1000 deposit goes back out into the economy and ends up deposited into another bank.

It will usually need to cover at least 5 of the cost of the property with a bank or building society lending you a mortgage to cover the rest. To a lender the length of time youve been making payments on a mortgage can make a great deal of difference if you wanted to change the terms by refinancing or take out equity all of a. Banks take some form of deposit or investment from consumers and in turn lend that money to others.

A key appeal of credit unions is a willingness to make small loans of 50 to 3000 which most high-street banks wont do. Mortgages and loans for example than the interest it pays its. Banks with deposits of 169 million or less didnt have a reserve requirement.

The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. Theyre a much cheaper alternative to payday loans and some credit unions can even get cash to you the same day. They dont have as.

Thats a lot of money just to access the equity in your. Uswitch can help you find the right mortgage deal for you and your circumstances. With Lend for Alls installment loans you can receive as much as 10000 in your bank account in no time all without a credit check.

These are usually interest-only mortgages which means you only repay the interest each month and reimburse the amount borrowed the capital at the end of the term. 52 Who should pay the costs. Weve partnered with Koodoo to help you compare mortgages from a range of different banks and buildings societies.

A high requirement is especially hard on small banks. You will typically need a deposit of at least 20 to be approved and the amount you can borrow. Open a bank account.

In most cases a 100 mortgage is only available through guarantor mortgages meaning youll need a guarantor usually a parent who will be responsible for paying the mortgage if you are unable to do so. With a median household income of roughly 70000 America consistently ranks in. Ever wonder how much money do the top income earners make.

How much could I borrow. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes. A buy-to-let mortgage is required if you are looking to buy a property to rent out as an investment.

Usually youll need a minimum of 10 of the propertys value to get a mortgage. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. The reason lenders use only 80 of your rent is that they assume that 20 of the rent you receive will be used to pay for managing agents fees council rates strata levies repairs and to cover for.

Compare between different banks and ask for pre-offers. Banks with more than 169 million up to 1275 million had to reserve 3 of all deposits. Youll need to spend a little longer on this.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. 5 FAQs on Getting a Mortgage in Spain. Browse websites such as Rightmove to see how much properties cost in the area you want to buy in then use our borrowing calculator to get a rough idea of how much you might be able to borrow.

Compare Offers and Choose The best option. And that youre reliable to lend to. Once you know how much the top income earners make then you can better shoot to be a top income earner yourself.

For a reverse mortgage they could run as much as 15000. In the US that typically involves the Fed buying securities through open market operations which gives banks more money to lend. It can also change reserve requirements for banks adjust the rates it pays for excess reserves and lower the Fed funds rate which determines how much banks charge each other for overnight lending.

The AAG Advantage Jumbo Reverse Mortgage. Banks do not have working capital due to the lack of typical current assets and liabilities accounts such as inventories. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Few mortgage lenders offer 100 mortgages where you are borrowing the full value of the property and have no cash deposit. 51 How much can the bank lend you for your mortgage. 46 Requirements for getting a NON RESIDENT SPANISH mortgage.

These banks are then able to lend out 90 of the 900 that was put into the account and on and on creating an exponentially increasing amount of money in the. Lenders fall into two categories. After all everything is relative when it comes to money.

Banks and non-bank lenders. Banks are allowed to lend out 90 of your deposit and can not touch 10 of it. If you want a more accurate quote use our affordability calculator.

A commercial bank is a type of financial institution that accepts deposits offers checking account services makes business personal and mortgage loans and offers basic. Third with installment loans you can borrow more moneyIn many cases the limit for a payday loan is something like 1500. Looking to remortgage get your first mortgage or move home.

How To Choose A Mortgage Lender Money

Pin On Finance Infographics

Bank Of America Mortgage Lender Review Nextadvisor With Time

Learn Everything You Need To Know About Mortgages

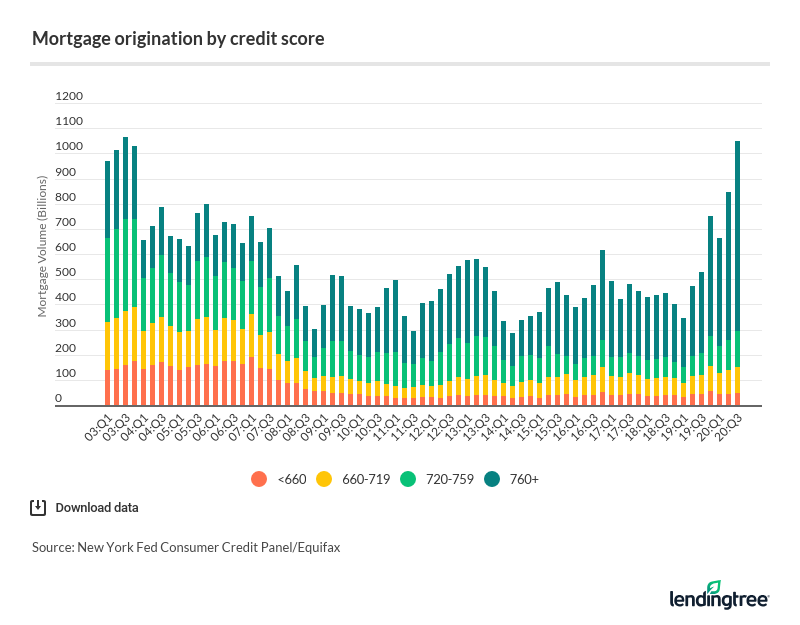

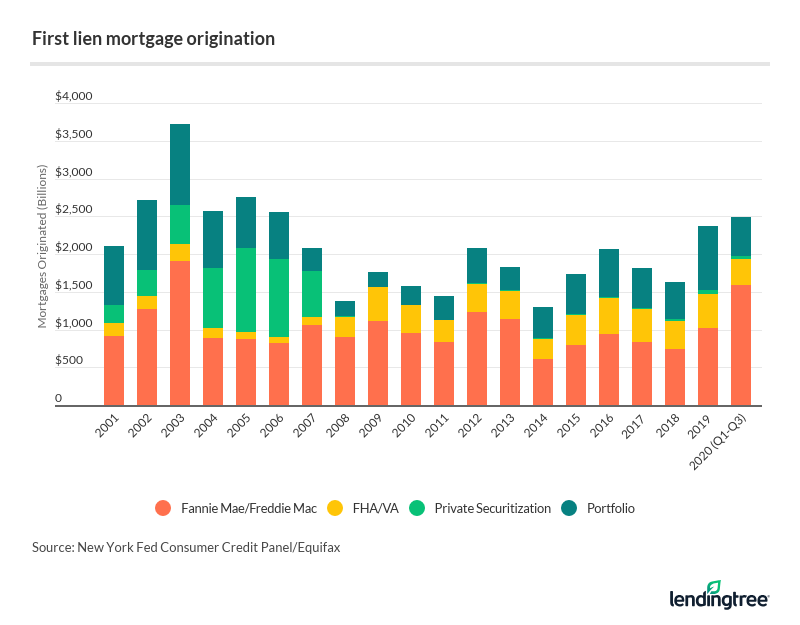

U S Mortgage Market Statistics 2020

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

Loan Officer Job Description Expected Salary And What Your Day Will Look Like

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

How The Federal Reserve Affects Mortgage Rates Discover

Direct Mail Letter I Assisted In Writing The Copy And Sending The Letters Writing Courses Communications Plan In Writing

Mortgage Bank Overview How It Functions Income Sources

U S Mortgage Market Statistics 2020

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Mortgage Brokers Vs Banks